Mobile Operators Talk 5G Timelines: Notes from our Microcast

The fourth episode our Microcast series was all about 5G deployment and data management – taking place in a business landscape that is rapidly evolving. This episode included exclusive contributions from Telefonica’s Diego R López, Senior Technology Expert, CTIO’s office and Chair of the ETSI Industry Specification Group on NFV, and Strategy Analytics’ Sue Rudd, Director of Networks and Service Platforms. They were interviewed by Fergus Wills, Director of Product Management for Enea.

This article builds on the themes of the Microcast – which you can watch here – and summarizes some of the issues raised.

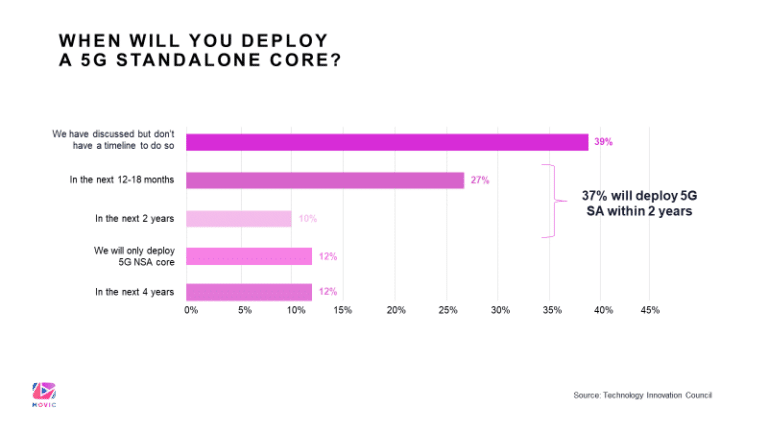

What is the timeline for deploying 5G standalone (SA)?

The first question of the survey asked operators about their timing for deploying 5G. More than 40 operators from around the world said they would deploy 5G within two years, and 12 percent of those said they’d do so by deploying 5G non-standalone (NSA) first. Operators that didn’t have a clear 5G deployment timeline said they were waiting on the maturity of specifications, such as 3GPP release 16, while others said they were validating the business case and/or waiting on spectrum auctions.

Because the survey took place before the Covid-19 pandemic hit, Sue was asked whether the 5G deployment timeline from the survey was still relevant. Sue said that while many people believe the virus will delay 5G, that’s not what’s happening, especially with operators in China. “The Chinese have come out of the virus peak, and have led all the contracts for service-based architecture. They are going as directly as they can to the service-based architecture to get down the volume curve.” She added “it’s all very well governments saying they don’t want to do business with the Chinese, we may well find they have the best technology and its 40% cheaper than anyone else’s!”

Sue said that while operators around the world say they’re planning to deploy 5G NSA, they’re quick to clarify that they’ll deploy islands of enterprise with a service-based architecture for enterprise customers that want low latency, high reliability and security for private apps. Sue believes that deployments initially may be LTE radio working with the new 5G core, as even conservative operators are considering it for “enterprise islands.”

Discussion then turned to how the global pandemic will impact 5G rollouts, especially as people have now become accustomed to accessing the internet for education, work, shopping and more at all hours of the day. The question was raised whether sustained massive demand for internet and the need to generate revenue from 5G networks will impact 5G deployment timelines. Sue believes these trends will impact both SA and NSA 5G deployments, with a significant paradigm shift occurring for operators as they move toward 5G SA. “A lot of people don’t realize that’s where the shift to cloud-native architecture happens – and it’s a big paradigm shift. But it’s one that the enterprise IT guys have no problem with.”

Diego was asked about his views on 5G timing in terms of both maturity of standards and maturity of technology. He indicated that he believes both are mature enough. “In fact, they have been thoroughly tested by many of the operators.” He pointed to use cases that operators have developed independently, as well as in collaboration with vertical customers.

Diego admitted that many operators are having to be more conservative economically, especially in response to Covid-19. “But on the other hand, he said, “the interesting thing is that the surge in traffic (in the current worldwide crisis) and the surge in new usages were not part of the normal consideration of many companies. It’s something our government is now talking about: ‘the new normal’. And the new normal will include ways of working and interacting between people that are unprecedented. I think that there are strong reasons for even accelerating 5G deployment in many different environments.”.

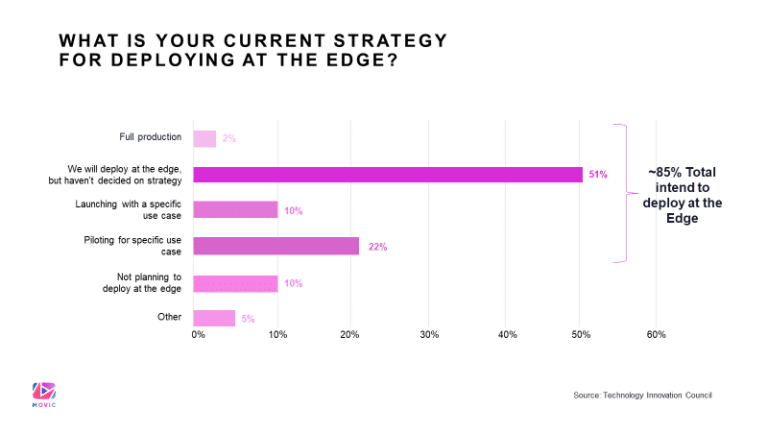

Will you deploy at the edge?

The microcast then turned to another question posed to operators in the survey: Will you deploy services at the edge? More than 80 percent of operators in the survey said they would deploy services at the edge, but more than half of those said they didn’t have a fully developed strategy for doing so.

Diego commented that the lack of a strategy depends on the operator. A number of his colleagues are working on an “operator platform” that provides an integrated way of providing services unique to each operator. He also explained that Telefonica is in a joint project with several other major operators worldwide, and they have a very clear strategy and are doing two things that are important. One is to involve the application providers from the very beginning. The second is about warrantying degrees of interoperability that go beyond just the interconnection of the “different edges” available. As such, an application developer looking to deploy eg with a Korean operator will be able to deploy in different places throughout Europe because the platforms are compatible – not only at the orchestration level, but also at the functional and platform levels.

Moreover, Diego said this scenario is resulting in operators driving vendors to be more harmonized in terms of their virtualization technologies, both in terms of how they’re deployed and where they’re deployed.

Sue said that many operators are starting to build in-processing power that is pre-deployed as a blade in a processor, especially as they move to open-source platforms. “But we’re also seeing what I’ll call the mundane business case, and the history of operators is they’ll very often deploy additional resources for internal use and cost savings. Their big fear with edge is they pre-deploy a lot of processor and storage for third-party apps, but they only show up in 10 percent of the locations, stranding a lot of assets.”.

Instead, Sue said many operators are deploying at the edge for internal applications like video buffering, load management for the radio access network and local breakout to Wi-Fi so they’re able to do load management across Wi-Fi with processor at the edge. The challenge, she said, is created by companies like Google, Amazon and Equinix, which are strongly deploying at the edge. The struggle is to drive users to the operator edge rather than building their own or even taking it on premise.

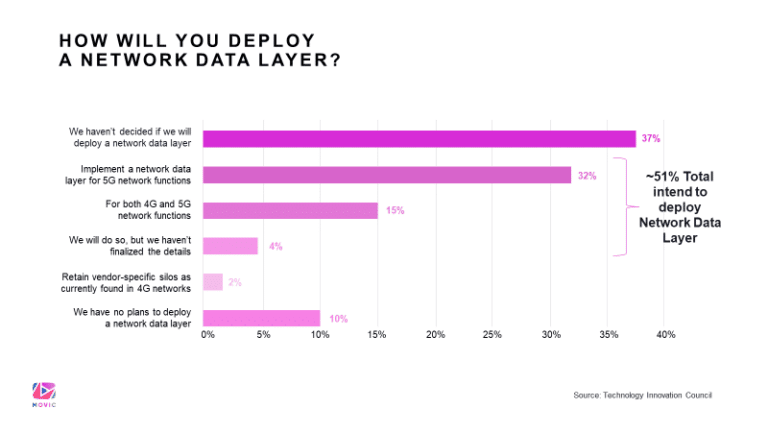

What’s the role of a common network data layer?

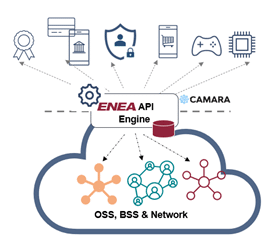

Lastly, the microcast examined one of the technical changes being accelerated by 5G. Operators in the survey were asked about the role of a common network data layer as a way of storing and sharing data persistently with low latency across the network and whether doing so is a tangible goal within a reasonable timeframe.

Sue said doing so today is difficult because a lot of data is embedded in the applications. So, until there is a containerized architecture that externalizes the data from the application, it could be difficult for different vendors to unbundle their applications, especially if they haven’t been designed that way. In fact, many have designed modular software that can be decomposed as microservices, but the data often is very tightly coupled.

However, she went on, one application that is driving the need for a common data layer near term is eSIM, which is found in devices like wearables, laptops, tablets and mobile phones. Authentication at eSIM and digital identity will be key drivers for bringing authentication data closer to the user at the edge, as well as separated in the common data layer across multiple service providers, multiple devices and even multiple networks.

Diego said Telefonica has run experiments to illustrate how having a common data layer helps in containerizing, especially if you’re not able to make stateless functions small enough and independent from their location. Additionally, they’re beginning to explore whether the stateless approach will help to decompose or disaggregate functions so parts of them can be implemented in programmable data devices like the P4-capable chips. These stateless characteristics could help further separate and disaggregate the entire network.

Finally, Sue and Diego wrapped up the microcast with final thoughts on 5G data management and deployment timelines.

Sue said the shared unified database becomes really essential as enterprise islands drive some of the earlier 5G SA deployments. She said there has been a push for fixed mobile convergence from fixed providers that could lead to early adoption of 5G SA. “For the services architecture, I think the real push will come from the fixed side over the next two years because that’s where the competitive pressure between cable and telecoms and the central office is, all of which desperately need to lower costs. The result is that 5G is a lower-cost solution than upgrading.”.

Diego cautioned operators against making hasty decisions driven by the current worldwide crisis. He quoted a 15th century Spanish Saint, Ignatius of Loyola: “make no changes in times of desolation”! And

Diego also agreed with Sue, saying the holy grail for operators will be the idea that you can now make real mobile and fixed convergence that unifies the network. “And the difference is not just the last mile but the last meters or last yard. It will translate into cost reduction and the possibility for much deeper automation, as well as unified services for customers.”.

Register for our Microcasts

Our short 15-minute videos bring together thought leaders and commentators to look at a range of mobile operator challenges and market opportunities. See the MOVIC website for more detail

In case you missed the first three microcasts…

- ABI Research, Tutela and Root Metrics looked at operator benchmarking – you can watch it here and read the accompanying blog here.

- Wired magazine and Analysys Mason examined the impact and potential of cloud gaming on 5G mobile network – watch it here and read the blog with bonus information.

- ABI Research and Strategy Analytics discussed how mobile operators in Europe, Asia and the Americas were managing their networks during the Covid-19 lockdowns – watch it here and read the bonus material here.

Want to speak on an upcoming Microcast?

We are always looking to add guest interviews, let us know if you think that could be you. Contact us: [email protected].